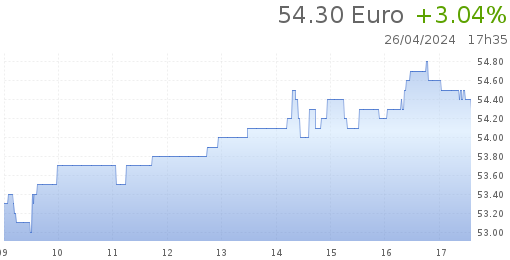

Assystem Share

Share price

Real time quotation

| Date |

23/02/2026 10:43:31 |

20/02/2026 17:35:10 |

|---|---|---|

| Last | 44.35 | 44.15 |

| Var % | +0.45% | +0.34% |

| First | 44.15 | 44.0 |

| + High | 44.35 | 44.2 |

| + Low | 43.85 | 43.7 |

| Turnover | 26758 | 66877 |

Comparison

| 52 weeks | 1st january | 6 months | 3 months | 1 month | |

|---|---|---|---|---|---|

| Variation % | +9.64 | +3.86 | -8.37 | +8.7 | -5.64 |

| Date + High | 19/08/2025 | 10/02/2026 | 25/08/2025 | 10/02/2026 | 10/02/2026 |

| + High | 49.6 | 48.3 | 48.9 | 48.3 | 48.3 |

| Date + Low | 07/04/2025 | 17/02/2026 | 17/10/2025 | 24/11/2025 | 17/02/2026 |

| + Low | 28.4 | 41.5 | 39.5 | 39.65 | 41.5 |

Financial calendar

-

10/02/2026Full-year 2025 revenue release

-

10/03/2026Full-year 2025 results release

-

11/03/2026Results presentation at 8.30 a.m. (CET)

-

23/04/2026First-quarter 2026 revenue release

-

22/05/2026Annual General Meeting

-

23/07/2026First-half 2026 revenue release

-

15/09/2026First-half 2026 results release

-

16/09/2026Results presentation at 8.30 a.m. (CEST)

-

27/10/2026Third-quarter 2026 revenue release

CAPITAL

Ownership structure

| At 2024/12/31 | % |

| HDL Development (1) | 57,93 % |

| Free float (2) | 34,41 % |

| Treasury Shares | 7,66 % |

(1) HDL Development is a holding company controlled by Dominique Louis (Assystem's Chairman and Chief Executive Officer), notably through HDL, which itself holds 0.85% of Assystem's capital

(2) Including 0.85% held by HDL

Dividend

| Year | Dividend paid for the year |

| 2020 | 1,00 € per share |

| 2021 | 1,00 € per share |

| 2022 | 1,00 € per share |

| 2023 | 12,50 € per share |

| 2024 | 1,00 € per share |

Key Figures

Financial presentations

2022 Half-year results presentation

15 September 2022

2021 annual results presentation

16 March 2022

2021 Half-year results presentation

16 September 2021

2020 annual results presentation

17 March 2021

2020 half-year results presentation

22 September 2020